If you’re involved in logistics, supply chain, warehousing, or heavy equipment operations in Saudi Arabia, then one city you must pay attention to is Dammam. Over the past few years Dammam has quietly but decisively positioned itself as a major logistics hub for the Eastern Province and for the Kingdom at large. In this post, we’ll explore why Dammam is becoming a logistics powerhouse, what are the main drivers pushing this change, and how businesses (including those renting cranes, managing heavy lifts or moving equipment) can benefit from this wave.

Whether you’re a crane rental company wondering about “how much does crane rental cost in Saudi Arabia” in the Eastern Province, or a business considering setting up a warehouse or logistics operation near Dammam, this article gives you the context and insight you need.

2. What makes Dammam a compelling logistics hub?

Dammam is the capital of the Eastern Province of Saudi Arabia, and part of the larger Dammam-Khobar–Dhahran metropolitan area.

Here’s what gives it a strong strategic foundation:

- Its proximity to the Gulf, major industrial zones (like Jubail Industrial City) and oil-&-gas operations.

- It houses the major seaport: King Abdul-Aziz Port (sometimes referred to as Dammam Port). For example, King Abdul-Aziz Port is described as “a major gateway on the Arabian Gulf supporting robust import and export volumes” with annual throughput of approximately 2.5 million TEU.

- The region’s logistical performance is improving: for example the Eastern Province’s logistical sector comes second in “comparative advantage rankings” by the Ministry of Economy and Planning.

- Government policy focus: The Eastern Province has the highest number of approved logistics areas (17 out of 59) across the KSA, reflecting where investment is being channeled.

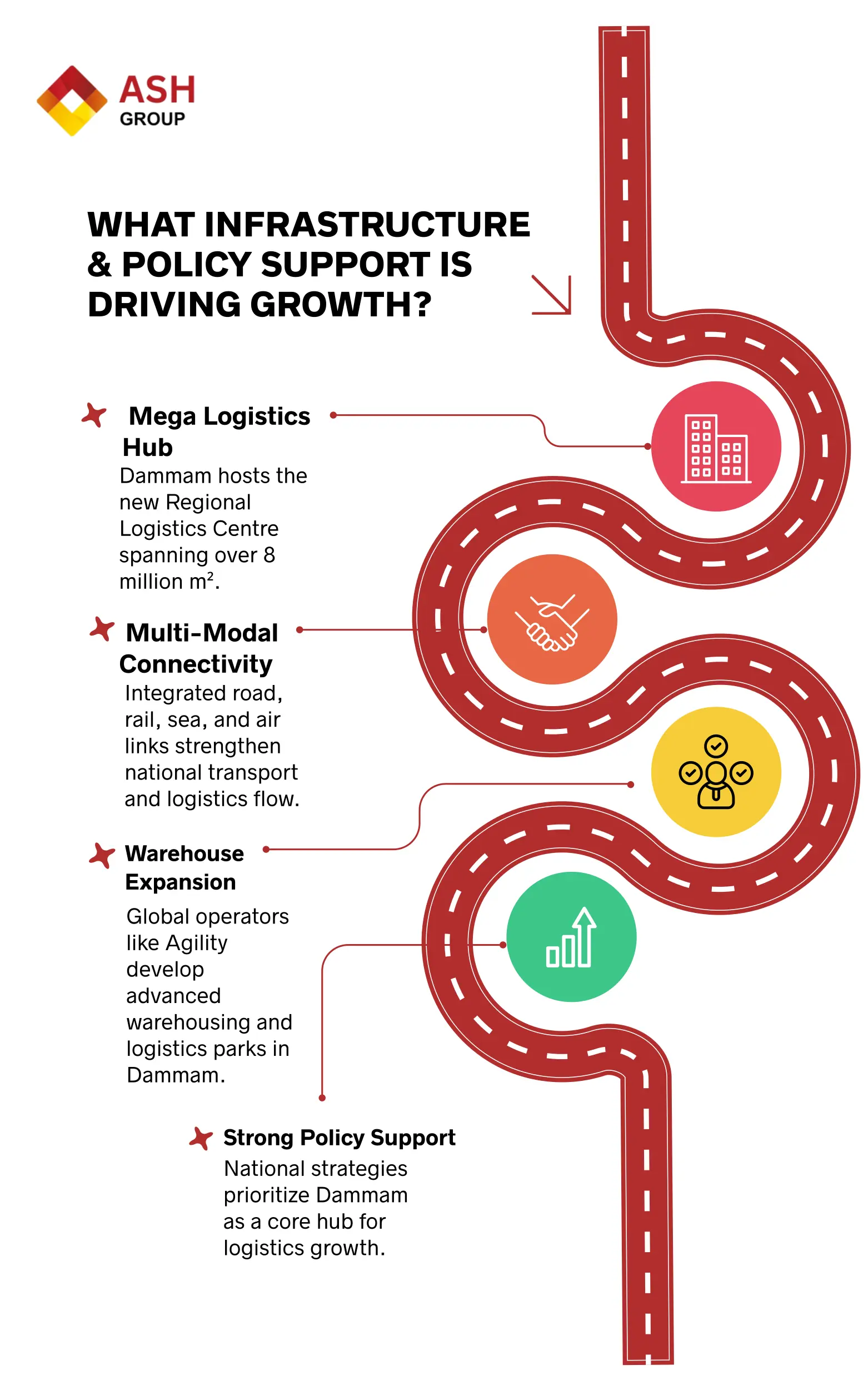

3. What infrastructure & policy support is driving growth?

A logistics hub doesn’t emerge merely by location it needs infrastructure, connectivity, regulatory support and investment. Dammam is seeing all of these:

- A large-scale project: The launch of a planned new “Regional Logistics Centre” (RLC) adjacent to Dammam with more than 8 million m² being developed by the Sharqia Development Authority.

- Multi-modal connectivity: The city is part of Saudi Arabia’s national strategy for transport and logistics which includes road, rail, sea and air links. For example, some sources point out the plan to expand the rail network to 8,000 km by 2030 and link Dammam’s port and industrial zones.

- Warehouse/logistics-park development: For instance, companies like Agility Logistics Parks operate in Dammam with warehousing and logistics infrastructure (e.g., “more than 1 million sqm of land, warehousing and logistics infrastructure in Saudi Arabia… in Riyadh and Dammam”).

- Policy and investment: The national goal (under the National Transport and Logistics Strategy) is to reposition KSA as a global logistics hub, and Dammam is a key node in that strategy.

3.1. What recent data supports the momentum?

A report noted that nearly 37 % of the Kingdom’s imports are via the Eastern Province’s ports, with King Abdulaziz Port handling 25 %.

The Saudi maritime logistics market was valued at USD 1.71 billion in 2024, and expected to reach USD 2.61 billion by 2033 (CAGR ≈ 4.3 %).

The logistics & warehousing market in KSA is valued around USD 37.8 billion in 2024 with high growth expectations.

All these point to rising infrastructure, flows, and investment in the Dammam/Eastern region logistics ecosystem.

4. Why is this important for equipment, crane rental and heavy lift markets?

Because as Dammam becomes more of a logistics hub, several knock-on effects occur particularly in equipment rental, heavy lifts, material handling, and construction/industrial support. Here’s how:

4.1. Increased construction & industrial activity

Logistics hub development means building warehouses, logistics parks, container terminals, internal roads, heavy-haul zones and more. These activities drive demand for heavy lifting, rigging, cranes and heavy equipment. For example:

Warehouse parks require large overhead cranes, all-terrain mobile cranes, heavy-lift mobile equipment

Industrial zones in the Eastern Province (oil & gas, petrochemical, manufacturing) link to Dammam’s logistics nodes.

4.2.Rise in warehousing & logistics operations

As more logistics parks and warehouses go up near Dammam (to take advantage of port/road/rail links), they also need handling equipment, mobile cranes for yard operations, container stacking, and heavy equipment movement.

4.3. Heavy-lift and export logistics

With Dammam’s port handling increasing volumes, including large cargo, heavy equipment exports/imports, rig moves, the need for Aramco-certified crane rental cost Saudi Arabia and mobile crane rental rate Saudi Arabia goes up. Offshore and onshore oil & gas segments (common in Eastern Province) will demand heavy-lift cranes and more specialized logistics and Transportation services.

4.4. Cost implications & rental market opportunities

For crane rental companies, being near a logistics hub means:

- Less downtime (more demand)

- Higher utilization rates

- Opportunity for larger capacity cranes (e.g., 160 ton, 500 ton)

Potential for competitive lease/rental rates but also pressure to meet certification, safety, maintenance and specialized scope

If you’re asking how much does crane rental cost in Saudi Arabia (and specifically around Dammam/Eastern Province), you’ll need to factor in the rising demand, specialization, jobsite complexity (oil/gas, export support, heavy-lift) and premium rates for certified/large capacity units.

5. What are the main factors that affect crane rental prices in the Dammam/Eastern Province market?

If you are benchmarking, estimating or preparing to hire equipment, here are the key variables you should see:

- Crane capacity & type: A 160 ton all-terrain crane will have a different rate compared to a 500 ton heavy-lift crane.

- Certification & scope: Many projects in the Eastern Province entail oil & gas or export logistics operations which require certifications (e.g., safety, ARAMCO approval). That affects pricing: e.g., Aramco-certified crane rental cost Saudi Arabia.

- Duration: Daily, weekly and monthly rates differ.

- Jobsite location & logistics: If you’re located in a remote site, offshore, or require additional transport/mobilisation, the cost climbs. E.g., crane rental cost in Eastern Province Saudi Arabia, crane rental cost in Dammam Saudi Arabia, crane rental cost in Jubail Saudi Arabia.

- Lift complexity and specs: Heavy-lift rigs, multi-crane lifts, heavy components, rig moves demand higher cost.

- Hidden costs: These include mobilisation/demobilisation, spares, down-time, operator fees, certification costs, fuel, crane pad preparation.

- Duration of rental and utilisation: High utilisation may get better rates; idle cranes mean higher cost per hour.

- Market supply & demand: Since Dammam and Eastern Province are rising logistics hubs, demand may push up rates for premium cranes in peak periods.

- Specialised requirements: For oil & gas, export, or heavy industrial lifts the crane rental may require special attachments, load-studies, certification, insurance all influencing pricing.

6. Why Dammam’s rise matters specifically for crane/supply-chain businesses

If your crane rental fleet or heavy-equipment business is in or near Dammam, you benefit from:

- Proximity to major port/sea access (less transport cost)

- Access to industrial clusters (Jubail, Khobar, etc) and rapid job-opportunities

- Being part of logistics growth warehouses, distribution, port expansion all drive demand

6.1. Predictable growth & jobs

Because Dammam is earmarked for large logistics-park development (e.g., 8 mn m² centre) and connected infrastructure, you can plan fleet capacity, service offerings (e.g., daily/weekly rentals, certified lifts, heavy-lift crew) accordingly.

6.2. Differentiation & premium services

Clients in this region often need heavy-lift cranes, oil & gas-certified services, export handling, and rig moves. If you can offer “Aramco-certified crane rental cost in Saudi Arabia” or “500 ton crane rental price in KSA” with safety/complex-lift credentialing, you can command higher rates and differentiate.

6.3. Supply-chain efficiency

As Dammam’s logistics ecosystem grows, you’ll see shorter mobilisation times, better infrastructure, improved services (road/rail/port) which reduce costs and risk for rental businesses.

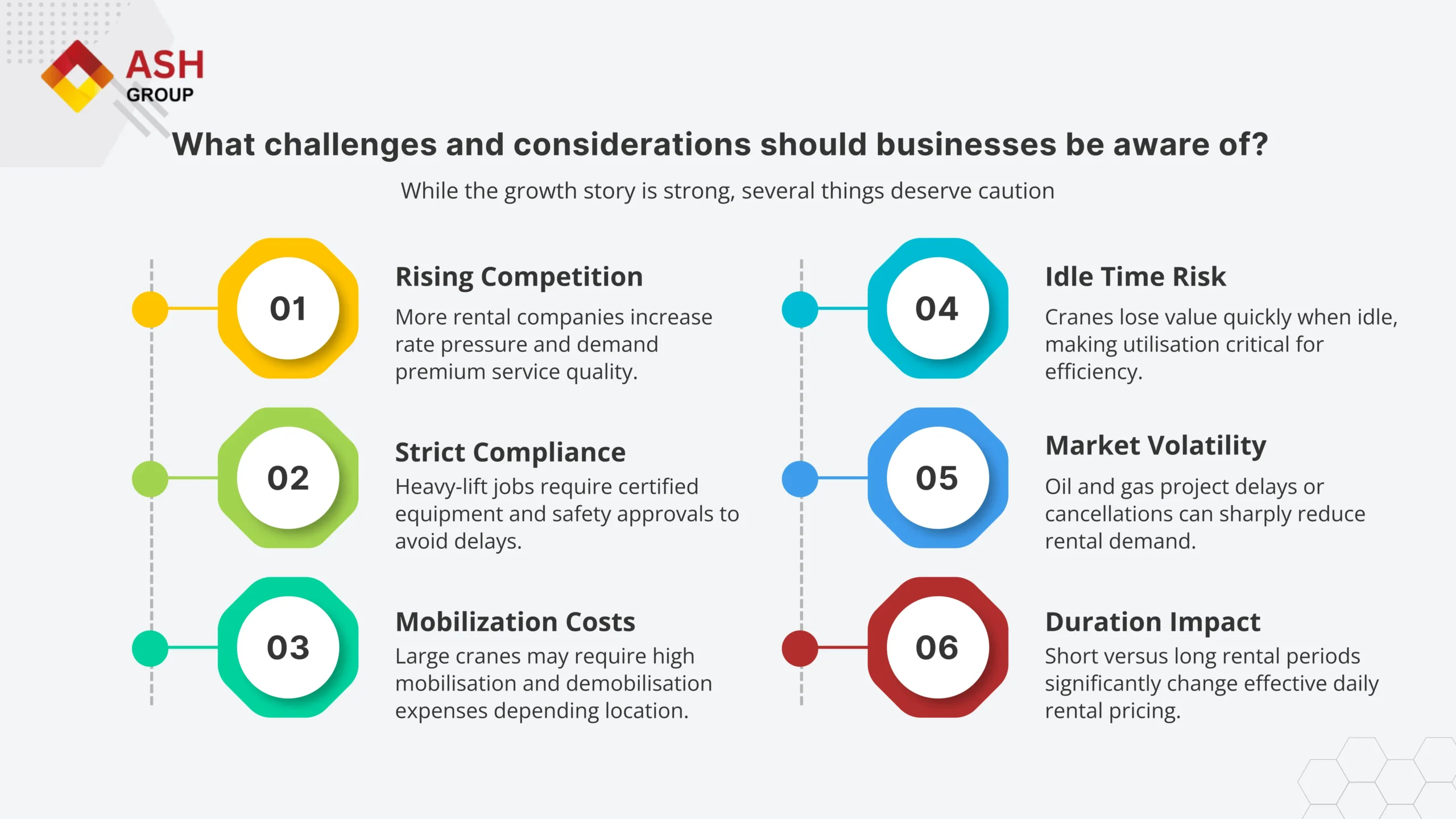

7. What challenges and considerations should businesses be aware of?

While the growth story is strong, several things deserve caution:

- Competition and rate pressure: As demand grows, more rental companies may enter, pushing rates down or forcing premium services to survive.

- Certification, safety, regulations: Heavy-lift jobs in the Eastern Province may require certifications (oil & gas, export, multi-crane lifts). Failing to comply can cost time and money.

- Mobilisation/logistics cost: Even though Dammam is a hub, depending on jobsite you may incur significant mobilisation/demobilisation expense (especially for large cranes).

- Idle time risk: A crane sitting idle depreciates cost-effectively faster than one actively rented. High utilisation is key to cost efficiency.

- Market fluctuations: Projects may get delayed or cancelled, especially in the oil & gas sector, meaning demand can drop.

Rental duration trade-offs: Hiring a crane for one day vs a week may change effective daily rates dramatically

8. What future trends should businesses monitor in Dammam’s logistics ecosystem?

As the new logistics centre near Dammam comes online (8 mn m² plus port/rail connectivity) we’ll see more jobs around warehousing, container handling, heavy lifts and transport operations.

This means crane rental firms should be ready for:

- Warehousing build-outs (structural lifts, roof cranes)

- Container terminal equipment lifts

- Rail/road infrastructure build-up

- Heavy-lifting for heavy equipment/deliveries

8.1. Growth of multi-modal connectivity

With roads, rail, sea and air all being improved, the region becomes more integrated. This reduces transport times and cost for equipment mobilisation, making implementation more efficient (thus reducing downtime and cost for crane rental).

8.2. Digital/automation & supply-chain sophistication

Logistics operations are becoming smarter: digital tracking, automation, IoT in warehouses.

While this doesn’t immediately change crane rental pricing, it does change job types (smaller, faster lifts, more precision, higher safety compliance) which may influence service offerings.

8.3. Sustainability and “green” logistics

Sustainability objectives are increasingly important in KSA. Logistics facilities and heavylift operations may require compliance with environmental standards, which may increase cost base but also premium services (e.g., low-emission cranes). Rental businesses that adapt will gain advantage.

8.4. Bigger/heavier lifts become standard

As infrastructure and logistics operations scale, tasks will become heavier and more complex (e.g., container terminals, large equipment trans-shipments). This drives demand for large capacity cranes (500 + tons) rather than just smaller mobile units.

9. Practical suggestions for businesses in this region For crane rental companies

- Invest in heavy capacity cranes (160 ton, 500 ton) and ensure certifications (oil & gas, terminal operations).

- Position yourselves near Dammam/Eastern Province to reduce mobilization cost and benefit from local demand.

- Offer flexible rental durations (daily, weekly) to appeal to various end-users.

- Provide value-add services: operator + rigging + site prep, to differentiate.

- Monitor hidden costs: fuel, travel, site preparation, down-time. Build them into your quotes and educate clients.

- Build partnerships with warehousing/logistics developers who are active in the Dammam region.

10:Logistics/warehousing/construction companies

When budgeting for crane rental, request quotes that clearly specify capacity, duration, certification, mobilization/demobilization, operator fees.

Consider location benefits: being near Dammam or the logistics parks may reduce mobilisation cost and downtime for crane rental.

For heavy-lift/industrial/rig-move projects, engage early with rental firms that understand the local Eastern province market (Dammam, Jubail, etc.).

Benchmark rates: Ask for comparable daily/weekly rates for 160 ton vs 500 ton units

Plan for downtime, secondary costs and hidden costs (such as standby time, operator overtime, weather delays) and build them into cost forecasting.

11. For equipment/asset-owners and planners

- Monitor market supply in the Eastern Province:

As Dammam grows, demand can push up rental rates for premium capacity cranes lock in rates early if you expect major lifts in the next 12–24 months. - Consider long-term lease vs purchase:

If you have repeated heavy-lift jobs in the Dammam region, owning might make sense. - Understand the local regulatory environment: Ensure any crane hire aligns with local standards, oil & gas site requirements, terminal/port operations rules.

12: Conclusion:

Dammam is no longer just a coastal city of the Eastern Province it’s rapidly evolving into a logistics hub at the heart of Saudi Arabia’s Eastern economic heartland. With major port capabilities, logistics-park investments, multi-modal connectivity and government backing, Dammam offers rich opportunities for businesses involved in heavy lifting, crane rental, equipment services and supply-chain operations.

If you’re in the business of crane rental or heavy-equipment rental, especially around the Eastern Province, here’s what you should do now:

- Assess your fleet: Do you have the right capacity (160 ton, 500 ton, all-terrain) and certifications to serve Dammam/Eastern-Region jobs?

- Position locally: Consider establishing a presence or partner in the Dammam area to reduce mobilization costs and increase responsiveness.

- Build your services: Emphasize value-adds (certified operators, rigging, site prep, daily/weekly rental options) and be transparent about hidden costs.

- Engage with logistics developers: Get into discussions with logistics parks, warehousing projects, port/rail developments in Dammam to be first in.

- Share insights: If you’ve had experience renting cranes in Saudi Arabia, share your benchmark rates, job flows, lessons learned others will appreciate it.

13: Frequently Asked Questions (FAQs)

Q: How much does crane rental cost in Saudi Arabia (specifically in Dammam/Eastern Province)?

A: There’s no one “fixed” number. Rates vary widely depending on capacity (160 ton vs 500 ton), jobsite (warehouse build-out vs rig move vs export terminal), certification (oil & gas vs standard), duration (daily vs weekly), location (close to Dammam vs remote), and additional cost factors (mobilisation, standby, rigging). Use “average crane rental rate in KSA” as a benchmark but expect variation.

Q: What is the cost difference between 160 ton and 500 ton crane rental in Saudi Arabia?

A: A 500-ton crane will command significantly more than a 160-ton in terms of hourly/daily rate, mobilization cost, operator cost, and support rigging.

Q: What boosts crane rental cost in the Eastern Province / Dammam region?

A: Key factors: industrial/export/port area, special certification (oil & gas, terminal), heavy lift complexity, remote or challenging site conditions, weekend/overtime labour, stand-by time, large mobilization/demobilization distance. (See what affects crane rental prices in Saudi Arabia.)

Q: Are there hidden costs I should be aware of when hiring cranes in Saudi Arabia?

A: Yes mobilization & demobilization transport costs, fuel, operator standby time, crane pad preparation, weather delays, overtime, rigging support, certification/tested load charts. Good rental companies will disclose these; ask explicitly. (See hidden costs in crane rental in Saudi Arabia.)

Q: Why is Dammam’s logistics growth relevant to me as a crane rental provider or heavy-equipment user?

A: Because growth in logistics parks, port/rail expansion, warehousing, terminal operations means more heavy-lift jobs, more demand for cranes and handling equipment, shorter mobilization routes, and clustering of work sites thus non-remote assignments and faster turnover.